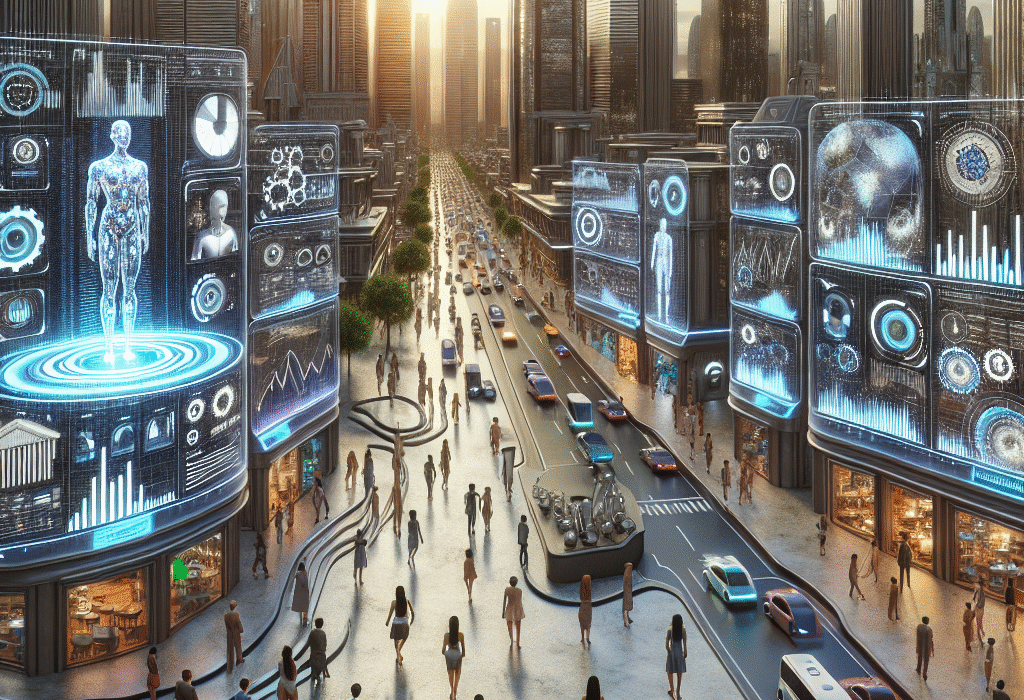

Have you ever imagined a future where AI agents are not only assisting us but also acting as customers themselves? Well, this might not be too far-fetched considering the rapid advancements in artificial intelligence and machine learning. In fact, AI agents are already reshaping the marketplace of the future, especially in sectors like consumer finance. Let’s dive into the exciting world where AI agents are becoming customers and what this means for you.

The Rise of AI Agents in Consumer Finance

In recent years, AI agents, powered by machine learning algorithms, have been gaining prominence in various industries, particularly in consumer finance. These AI agents are designed to analyze data, make decisions, and interact with customers just like a human would. From chatbots providing customer support to algorithmic trading systems making investment decisions, AI agents are becoming an integral part of the financial services sector.

Benefits and Challenges of AI Agents as Customers

-

Speed and Efficiency: AI agents can process vast amounts of data in a fraction of the time it would take a human.

-

Automation Bias: There is a potential risk of bias in decision-making processes if not properly monitored and regulated.

-

Paywalling Humans: As AI agents become more sophisticated, there’s a concern that they may replace human workers, leading to unemployment in certain sectors.

-

Need for Oversight: It is crucial to have oversight and regulation to ensure that AI agents are making fair and ethical decisions.

Personal Anecdote: Mortgage Broker AI

Imagine waking up to a notification on your phone from an AI mortgage broker informing you that they have renegotiated your mortgage rates for you. Sounds convenient, right? But it also raises questions about the role of AI agents in the financial decision-making process and the potential impact on human brokers.

What This Means for You

As a consumer, you might have noticed the increasing presence of AI agents in your everyday interactions, from virtual assistants on your smartphone to personalized recommendations on e-commerce platforms. While AI agents offer convenience and efficiency, it is essential to be mindful of the potential risks and challenges they bring.

Takeaway and Prediction

In the marketplace of the future, AI agents will continue to play a significant role in shaping consumer finance and other industries. However, it is crucial to strike a balance between embracing AI technology and ensuring ethical oversight to prevent any negative repercussions. As AI continues to evolve, so too must our regulatory frameworks and ethical standards.

What are your thoughts on this trend? Let me know what you’d choose.