Hey there, tech enthusiasts! Have you ever thought about how our world is evolving with the advancements in technology, especially in the realm of Artificial Intelligence? Well, if you’re intrigued by the concept of Autonomous AI and how it’s reshaping the financial industry, then you’re in for a treat. Let’s dive into the realm of Agentic AI and explore how it’s revolutionizing decision-making processes in banking.

The Revolution of Agentic AI

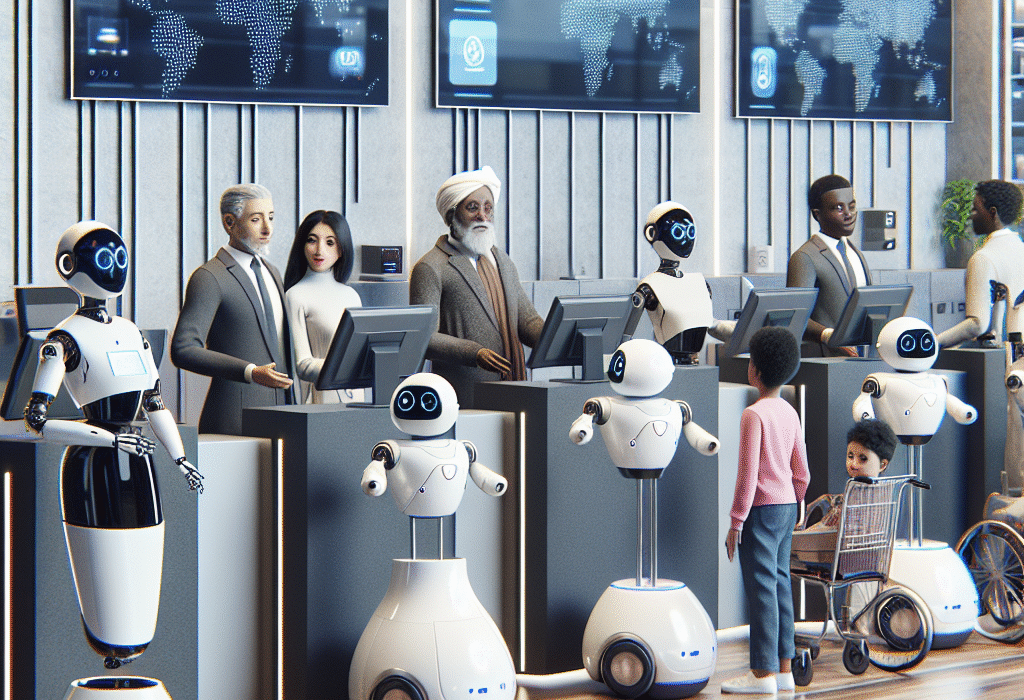

Autonomous AI, also known as Agentic AI, is taking the financial industry by storm. It’s all about granting software the power to make decisions independently, without constant human supervision. Think of it as empowering AI to act as a digital colleague, capable of running operations for minutes, hours, or even days on end. This shift marks a significant evolution in how banks operate and make crucial decisions.

Unleashing the Power of Autonomous Decisions

Imagine a world where AI systems can autonomously analyze data, detect patterns, and execute trades in real-time, all without human intervention. With Agentic AI, this futuristic vision is becoming a reality. Banks are leveraging autonomous decision-making capabilities to streamline operations, minimize errors, and enhance efficiency in their processes.

Some key benefits of Agentic AI in the financial industry include:

-

Improved accuracy and speed in decision-making

-

Enhanced risk management through real-time monitoring

-

Cost reduction by eliminating manual tasks

-

Greater scalability to handle complex operations

-

Enhanced customer experience with personalized services

Challenges on the Horizon

While the potential of Agentic AI is promising, there are challenges that need to be addressed for its widespread adoption in the financial sector. Some of the hurdles include:

-

Ensuring regulatory compliance and ethical use of AI

-

Data privacy and security concerns

-

Overcoming biases in AI algorithms

-

Training AI systems to handle complex, unpredictable scenarios

-

Building trust among customers and stakeholders

Navigating these challenges will be crucial for banks looking to harness the full potential of Autonomous AI in their operations.

What This Means for You

As a tech-savvy individual, you might have noticed the increasing presence of AI in various aspects of your daily life. From personalized recommendations on streaming platforms to voice assistants in your smart devices, AI is all around us. The rise of Agentic AI in the financial industry signals a shift towards more autonomous, data-driven decision-making processes.

So, what does this mean for you? Well, as consumers, you can expect to see more personalized services, faster transactions, and enhanced security measures in your banking experiences. On the flip side, you might also need to adapt to a new era where AI plays a more prominent role in shaping financial services.

The Future of Agentic AI in Banking

Looking ahead, the future of Agentic AI in the banking industry holds immense potential for innovation and growth. With advancements in machine learning, natural language processing, and predictive analytics, AI systems will become even more adept at handling complex financial tasks autonomously.

As technology continues to evolve, banks will need to strike a balance between leveraging AI for efficiency gains and maintaining human oversight for ethical decision-making. Finding this balance will be essential in reaping the full benefits of Agentic AI while upholding trust and transparency in the financial sector.

What Are Your Thoughts on This Trend?

As we wrap up our exploration of Agentic AI and its implications for the financial industry, I’m curious to hear your thoughts. Are you excited about the rise of Autonomous AI in banking, or do you have reservations about its potential impact? Let me know what you’d choose. Keep exploring the ever-evolving landscape of technology, and stay tuned for more exciting updates!

Until next time, happy teching!