As global industries rapidly shift toward immersive digital ecosystems, the metaverse has emerged as one of the most significant growth trends of the decade. Investors are looking to position themselves early in the companies enabling this evolution. With a blend of hardware innovation, software integration, and business applications, the metaverse is no longer speculative it’s actionable.

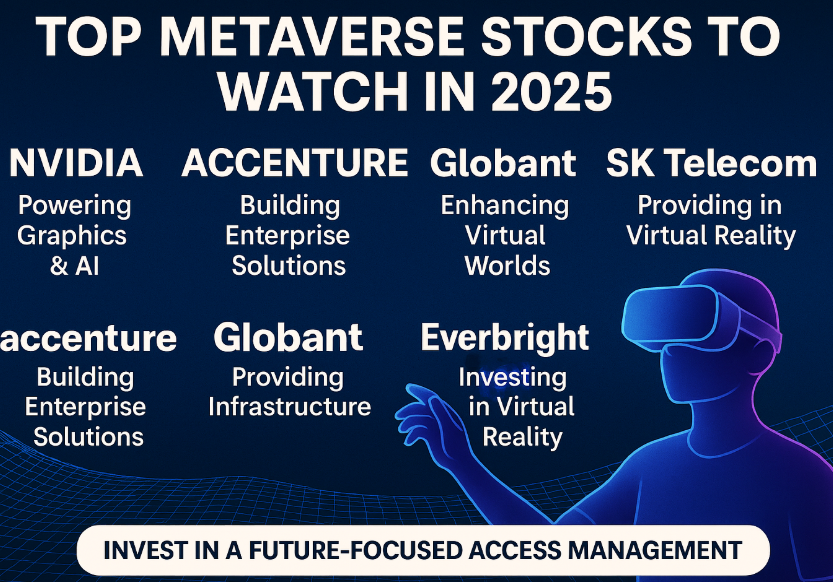

Here’s a detailed look at five publicly listed companies playing key roles in the metaverse transformation: NVIDIA, Accenture, Globant, SK Telecom, and Everbright Digital. Each brings a unique strength from chip manufacturing to immersive software design and represents potential value for investors.

NVIDIA: Powering the Engine of Graphics and AI

NVIDIA is widely regarded as the technological foundation of the metaverse, thanks to its dominance in GPUs and AI infrastructure. The company’s chips not only enable real-time rendering in immersive worlds but also power AI models that underpin virtual economies, avatars, and simulations.

Key Drivers:

-

NVIDIA’s Omniverse platform is a digital twin engine that enables collaborative 3D workflows, central to virtual manufacturing and world-building.

-

The company’s advances in ray tracing and deep learning position it as a leader in hyper-realistic simulations and AI-generated content.

-

With growing adoption across gaming, digital design, and AI modeling, NVIDIA remains one of the most critical enablers of the metaverse.

Investment Insight:

As a hardware-first leader with expanding software infrastructure, NVIDIA continues to attract strong institutional interest, making it a top-tier metaverse stock to monitor.

Accenture: Building Enterprise Bridges into the Metaverse

Accenture is not a hardware company but its role in the metaverse is just as vital. With over 600 patents filed around immersive technologies, it is a leader in implementing custom metaverse solutions for enterprise clients.

Key Drivers:

-

Accenture has built partnerships with Meta, Microsoft, and others to integrate VR and AR into real-world workflows.

-

It operates the Nth Floor, a virtual collaboration space designed to enhance remote working and onboarding.

-

Its consulting services are actively shaping how industries like healthcare, retail, and education adopt immersive tools.

Investment Insight:

As an implementation powerhouse with deep client relationships and strong digital transformation credentials, Accenture is a metaverse enabler that offers stable long-term growth.

Globant: The Creative Builder of Virtual Worlds

Argentinian-based Globant is a digital-native services company known for its specialization in AI, blockchain, and virtual reality development. Globant focuses on storytelling, design, and experience three core pillars of the metaverse user layer.

Key Drivers:

-

Globant has developed immersive campaigns and environments for brands like Google, Disney, and EA.

-

It has invested heavily in developing AI + XR platforms for commercial and entertainment use.

-

Its decentralized studio model allows for scalable metaverse development across sectors.

Investment Insight:

With recurring revenue from creative services and increasing demand from enterprise clients, Globant is positioned as a high-growth stock within the metaverse services niche.

SK Telecom: Laying Down the Infrastructure

South Korea’s SK Telecom brings 5G infrastructure, edge computing, and XR investment to the table. As one of Asia’s leading telcos, it provides both the data highways and emerging platforms for immersive content delivery.

Key Drivers:

-

SK Telecom has launched ifland, a proprietary metaverse social platform with millions of users across Asia.

-

The company is investing in low-latency cloud infrastructure for immersive gaming and virtual collaboration.

-

It has formed alliances with Qualcomm and other chipset manufacturers to enhance device compatibility.

Investment Insight:

As telecoms play a foundational role in enabling seamless VR/AR connectivity, SK Telecom represents a unique infrastructure-focused metaverse investment.

Everbright Digital: China’s Strategic VR Investment

Everbright Digital, a division of China Everbright Group, is building a consumer metaverse ecosystem via strategic investments in gaming, social platforms, and virtual commerce.

Key Drivers:

-

The company is involved in developing immersive financial products, virtual real estate, and digital avatars.

-

It is building a China-based platform that aligns with regional regulations and user preferences.

-

Everbright’s metaverse arm has already launched early-stage marketplaces with digital identity management tools.

Investment Insight:

While still in the early stages, Everbright Digital offers ground-floor exposure to China’s expanding domestic metaverse, which is expected to scale aggressively in the coming years.

What This Means for Investors

Metaverse stocks are no longer hype they are strategic plays in digital transformation. Whether you’re an institutional investor or an individual seeking high-growth tech stocks, positioning in this segment requires diversification across:

-

Hardware enablers (NVIDIA)

-

Enterprise solution providers (Accenture)

-

Creative developers (Globant)

-

Infrastructure leaders (SK Telecom)

-

Regional growth players (Everbright Digital)

Investing in metaverse leaders today may position you ahead of the curve, especially as AI, 5G, and virtual commerce converge into mainstream platforms.

Final Thought: Is the Future Virtual?

The metaverse remains an evolving narrative but the foundations are already here. As companies scale their infrastructure, create new applications, and unlock immersive experiences, the market is shifting from early adoption to global acceleration.

These top five stocks represent a balanced entry into the metaverse investment space each one contributing to a different layer of the virtual economy. As always, evaluate risks, research quarterly earnings, and monitor technological roadmaps before making any investment decisions.